Gravita India Limited is showing a strong swing setup after rebounding from the 61.8% retracement zone, aligned with the 100-week EMA support. The stock has broken a downward trendline with volume and is forming higher bottoms above the POC. RSI strength and a bullish MACD crossover on weekly charts signal improving momentum and potential upside continuation.

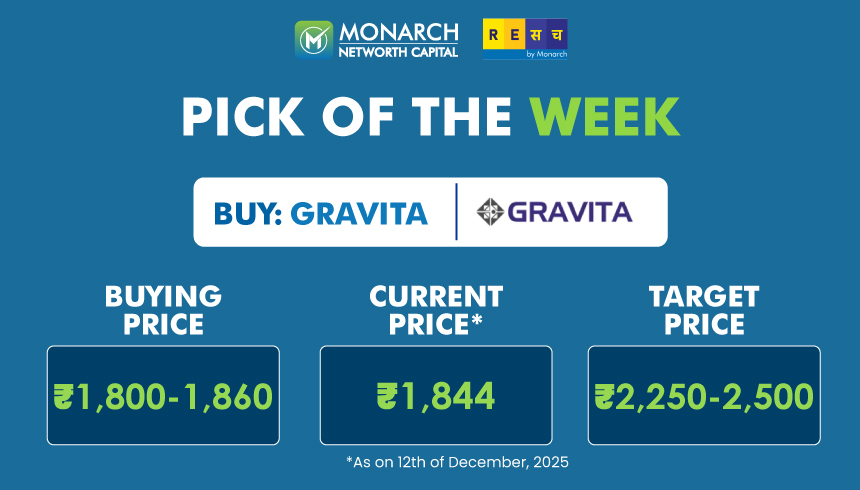

Traders can look to accumulate GRAVITA in the 1,800–1,860 zone and expect upside targets of 2,250–2,500 over the next 10–12 weeks, with a stop loss below 1,530 on a closing basis.

💡 Learn to find more such setups with our swing trading guide to stay ahead of market opportunities.

Website: https://www.gravitaindia.com/

Gravita India Ltd is a leading global recycling company specializing in lead, aluminum, and plastic recycling. With operations across multiple countries, the company focuses on sustainable metal recycling, circular economy solutions, and value-added products, serving automotive, infrastructure, and industrial sectors worldwide.

Gravita India has drawn traders’ attention due to its strong price recovery from long-term support zones and improving momentum indicators. Below are key questions investors often ask when evaluating this swing trading setup.

Gravita India is showing a favorable swing setup with a trendline breakout, higher bottom formation, and strong volume-backed buying interest.

The setup is supported by RSI holding above 50 on daily and weekly charts, a bullish MACD crossover above zero, and price sustaining above the POC level.

The stock rebounded from the 61.8% Fibonacci retracement, which coincides with the 100-week EMA—creating a strong long-term support confluence.

Based on the breakout structure and momentum profile, the move could unfold over the next 10–12 weeks if market conditions remain supportive.

Traders should track price sustainability above the breakout trendline, volume expansion, and RSI holding above 50 for confirmation of trend continuation.

Disclaimer: - Investments in securities market are subject to market risk, read all the related document carefully before investing. https://www.mnclgroup.com/research-disclaimer

Empower your finances with ReSach – the stock trading apptrusted by serious investors. Whether you're planning to invest in stocks, explore commodity trading, or need a financial advisor to guide you, Resach brings it all under one platform.

Start trading today with ReSach and unlock seamless investing on the go.

Name of the Company has changed from Networth Stock Broking Limited to Monarch Networth Capital Limited upon Certification of Incorporation received from Registrar of Companies, Mumbai vide certificate dated 13th October, 2015.

If you are not satisfied with the resolution provided, you can lodge your complaint online at: https://scores.sebi.gov.in/link

In case of grievance client can log on to the SMART ODR Portal, if they are unsatisfied with the response provided by us. Your attention is drawn to the SEBI circular no. SEBI/HO/OIAE/OIAE_IAD-1/P/CIR/2023/131 dated July 31, 2023, on “Online Resolution of Disputes in the Indian Securities Market”.

Purchase of REs only gives buyer the right to participate in the ongoing Rights Issue of the concerned company by making an application with requisite application money or renounce the REs before the issue closes. REs which are neither subscribed by making an application with requisite application money nor renounced, on or before the Issue closing date shall lapse and shall be extinguished after the Issue closing date. Please check your dp account for further details.

Please do not share your online trading password with anyone as this could weaken the security of your account and lead to unauthorized trades or losses.

Monarch Networth Capital Limited (‘MNCL’) | CIN No.: L64990GJ1993PLC120014

Unit No. 803-804A, 8th Floor, X-Change Plaza, Block No. 53, Zone 5, Road-5E, Gift City, Gandhinagar - 382050, Gujarat

Ahmedabad

“Monarch House”, Opp Prahladbhai Patel garden, Near Ishwar Bhuvan, Commerce Six Roads, Navrangpura, Ahmedabad - 380009

Mumbai

Monarch Networth Capital Limited, G Block, Laxmi Tower, B Wing, 4th Floor, Bandra Kurla Complex, Bandra East, Mumbai - 400051.

Email for Grievance: grievances@mnclgroup.com

Investors are requested to note that Stock broker (Monarch Networth Capital Ltd) is permitted to receive money from investors through designated bank accounts only named as Up streaming Client Nodal Bank Account (USCNBA). Stock broker (Monarch Networth Capital Ltd) is also required to disclose these USCNB accounts to Stock Exchange. Hence, you are requested to use following USCNB accounts only (Click to View) for the purpose of dealings in your trading account with us. The details of these USCNB accounts are also displayed by Stock Exchanges on their website under “Know/ Locate your Stock Broker".

Mechanism for addressing grievances and information about SCORES.

Monarch Networth Capital IFSC Private Limited (Wholly owned subsidiary of Monarch Networth Capital Limited) is a Registered Fund Management Entity (Retail) having Registration No: IFSCA/FME/III/2025-26/169. Monarch India Growth Fund will be an open-ended Restricted Scheme (Non-Retail) construed as a Category III AIF under the IFSCA (Fund Management) Regulations, 2025. Monarch AIF is a Category III AIF having SEBI Registration No. IN/AIF3/20-21/0787. This material is for informational purposes only and is not intended as an offer or solicitation or investment advice to buy or sell securities. Investments are subject to market risks. The offering is made only through official scheme documents to eligible investors under GIFT IFSC regulations. Investors should read all documents carefully and consult their advisors before investing.

Mechanism for addressing grievances and information about SCORES.

Monarch Networth Capital Limited (‘MNCL’) | CIN No.: L64990GJ1993PLC120014

(As per LODR Regulations and Companies Act, 2013)

Contact information of the designated officials of the listed entity who are responsible for assisting and handling investor grievances : Mr. Nitesh Tanwar

Monarch Networth Capital Limited

Unit No. 803-804A, 8th Floor, X-Change Plaza, Block No. 53, Zone 5, Road-5E, Gift City, Gandhinagar - 382050, Gujarat

Ahmedabad

“Monarch House”, Opp Prahladbhai Patel garden, Near Ishwar Bhuvan, Commerce Six Roads, Navrangpura, Ahmedabad – 380009

Mumbai

Monarch Networth Capital Limited, G Block, Laxmi Tower, B Wing, 4th Floor, Bandra Kurla Complex, Bandra East, Mumbai - 400051.

Phone: 022 - 66476400 / 66476405

Email: cs@mnclgroup.com

Email for Grievance: cs@mnclgroup.com

Listing of Equity Shares on Stock Exchange at

BSE

NSE

(Formerly known as Link Intime India Private Limited)

For any queries related to broking please contact helpdesk@mnclgroup.com.

‘Investments in securities market are subject to market risks, read all the related documents carefully before investing.’