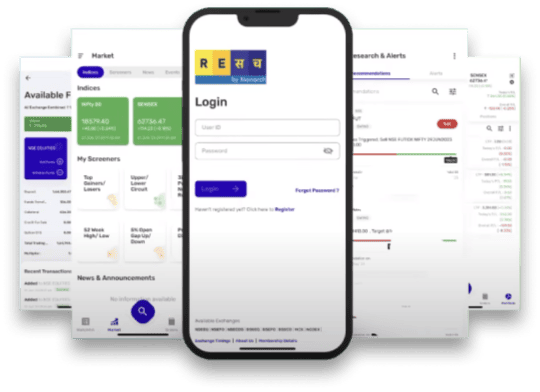

Clarity in Complexity

We unravel the complexities of financial products, offering clear, jargon-free explanations. Our primary objective is to ensure product suitability through comprehensive understanding, simplifying the intricacies to empower our clients.