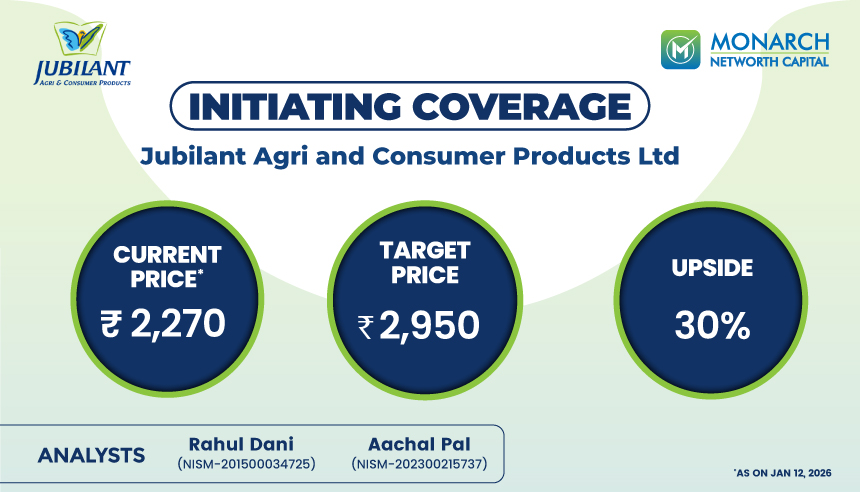

We Initiate coverage on Jubilant Agri & Consumer Products Ltd (JACPL), a thinly researched company, with a Target price of Rs. 2,950. A part of the well-regarded Jubilant Bhartia Group, JACPL has quietly built one of the fastest-growing adhesive brands in India, leveraging the group’s deep chemical capabilities and disciplined execution. In adhesives, the company has consistently outperformed larger peers, delivering industry-beating growth alongside steady margin expansion. Its upcoming capacity additions and distribution build-out provide strong visibility for sustained growth over the next few years. While the adhesives business is emerging as the company’s core growth engine, its leadership position in Food Polymers and VP Latex provides a stable, high-margin cash-cow foundation. JACPL is also in the process of demerging its highly cyclical agri-business—where profitability has improved recently but remains structurally volatile. The separation is a clear value-unlocking opportunity and should sharpen strategic focus on the high-quality consumer and polymer platforms.

JACPL’s adhesive division (Jivanjor) has emerged as one of the fastest-growing brands in the category, consistently outperforming industry growth and gaining share from established leaders. Backed by strong chemistry capabilities, a rapidly expanding distribution footprint with 1200+ distributors and 27,000+ retailers, and sustained investments in contractors (3lacs+) and influencers, the business is entering a multi-year scale-up phase. New capacity in the West, deeper penetration in Tier-2/3 markets, and a technology-led product portfolio (fast drying, high coverage, eco-friendly) position adhesives as the company’s core long-term growth engine.

JACPL’s Food Polymer and Latex businesses form a stable, high-margin backbone, providing predictable cash flows and strong ROCE (65% FY25). With entrenched customer relationships, long approval cycles, and minimal competitive intensity, these segments operate as steady annuity businesses. The recent foray into SBR (Styrene-Butadiene Rubber) Latex adds an optional growth lever, but the core polymer portfolio already offers resilience, visibility, and the financial strength to fund the aggressive expansion of the adhesives franchise.

JACPL is in the process of demerging its cyclical Agri business—a segment that, despite recent improvement, remains structurally volatile and subsidy-dependent. Separating this division will sharpen strategic focus on the company’s high-quality Adhesives and Industrial Polymer businesses, improve earnings visibility, and unlock value by allowing each entity to be valued on its true fundamentals. The demerger also enhances capital allocation clarity and positions the core consumer–polymer platform for a cleaner, more sustainable growth trajectory.

We are factoring 14% revenue CAGR / ~310bps expansion in margins over FY25–FY28E, supported by steady growth, healthy margins in the industrial polymers segment, and scale benefit from the adhesives business. We value JACPL on a SOTP basis to arrive at TP of Rs. 2,950; valued the fast-growing adhesives business on PE basis and at 50% discount to its largest peers, other businesses accordingly. Initiate with a BUY rating. Key risks: Volatile raw material prices, potential butadiene supply disruptions, and a slowdown in the construction sector impacting production and profitability.

Company website: https://www.jacpl.co.in/

| Parameter | Details |

|---|---|

| Rating | BUY |

| Current Market Price (CMP) | Rs 2,270 |

| Target Price | Rs 2,950 |

| Upside | 30% |

Click to download the full Jubilant Agri & Consumer Products IC Report

Jubilant Agri & Consumer Products is gaining attention as an emerging challenger in the Indian adhesives and specialty polymers space. Here are the key questions investors are asking.

The adhesives division is one of the fastest-growing in India, gaining market share through strong chemistry capabilities, rapid distribution expansion, and contractor-led brand adoption.

Food Polymers and Latex businesses generate stable, high-margin cash flows with strong ROCE, supporting funding for aggressive growth in consumer adhesives.

The demerger separates a cyclical, subsidy-linked business, improving earnings visibility and allowing the core consumer–polymer platform to be valued more accurately.

Yes. Improving business mix, margin expansion visibility, and corporate actions like demerger often act as medium-term re-rating triggers for swing trades.

Disclaimer: - You are advised to read our disclaimer here: https://www.mnclgroup.com/disclaimers

Empower your finances with ReSach – the stock trading apptrusted by serious investors. Whether you're planning to invest in stocks, explore commodity trading, or need a financial advisor to guide you, Resach brings it all under one platform.

Start trading today with ReSach and unlock seamless investing on the go.

Name of the Company has changed from Networth Stock Broking Limited to Monarch Networth Capital Limited upon Certification of Incorporation received from Registrar of Companies, Mumbai vide certificate dated 13th October, 2015.

If you are not satisfied with the resolution provided, you can lodge your complaint online at: https://scores.sebi.gov.in/link

In case of grievance client can log on to the SMART ODR Portal, if they are unsatisfied with the response provided by us. Your attention is drawn to the SEBI circular no. SEBI/HO/OIAE/OIAE_IAD-1/P/CIR/2023/131 dated July 31, 2023, on “Online Resolution of Disputes in the Indian Securities Market”.

Purchase of REs only gives buyer the right to participate in the ongoing Rights Issue of the concerned company by making an application with requisite application money or renounce the REs before the issue closes. REs which are neither subscribed by making an application with requisite application money nor renounced, on or before the Issue closing date shall lapse and shall be extinguished after the Issue closing date. Please check your dp account for further details.

Please do not share your online trading password with anyone as this could weaken the security of your account and lead to unauthorized trades or losses.

Monarch Networth Capital Limited (‘MNCL’) | CIN No.: L64990GJ1993PLC120014

Unit No. 803-804A, 8th Floor, X-Change Plaza, Block No. 53, Zone 5, Road-5E, Gift City, Gandhinagar - 382050, Gujarat

Ahmedabad

“Monarch House”, Opp Prahladbhai Patel garden, Near Ishwar Bhuvan, Commerce Six Roads, Navrangpura, Ahmedabad - 380009

Mumbai

Monarch Networth Capital Limited, G Block, Laxmi Tower, B Wing, 4th Floor, Bandra Kurla Complex, Bandra East, Mumbai - 400051.

Email for Grievance: grievances@mnclgroup.com

Investors are requested to note that Stock broker (Monarch Networth Capital Ltd) is permitted to receive money from investors through designated bank accounts only named as Up streaming Client Nodal Bank Account (USCNBA). Stock broker (Monarch Networth Capital Ltd) is also required to disclose these USCNB accounts to Stock Exchange. Hence, you are requested to use following USCNB accounts only (Click to View) for the purpose of dealings in your trading account with us. The details of these USCNB accounts are also displayed by Stock Exchanges on their website under “Know/ Locate your Stock Broker".

Mechanism for addressing grievances and information about SCORES.

Monarch Networth Capital IFSC Private Limited (Wholly owned subsidiary of Monarch Networth Capital Limited) is a Registered Fund Management Entity (Retail) having Registration No: IFSCA/FME/III/2025-26/169. Monarch India Growth Fund will be an open-ended Restricted Scheme (Non-Retail) construed as a Category III AIF under the IFSCA (Fund Management) Regulations, 2025. Monarch AIF is a Category III AIF having SEBI Registration No. IN/AIF3/20-21/0787. This material is for informational purposes only and is not intended as an offer or solicitation or investment advice to buy or sell securities. Investments are subject to market risks. The offering is made only through official scheme documents to eligible investors under GIFT IFSC regulations. Investors should read all documents carefully and consult their advisors before investing.

Mechanism for addressing grievances and information about SCORES.

Monarch Networth Capital Limited (‘MNCL’) | CIN No.: L64990GJ1993PLC120014

(As per LODR Regulations and Companies Act, 2013)

Contact information of the designated officials of the listed entity who are responsible for assisting and handling investor grievances : Mr. Nitesh Tanwar

Monarch Networth Capital Limited

Unit No. 803-804A, 8th Floor, X-Change Plaza, Block No. 53, Zone 5, Road-5E, Gift City, Gandhinagar - 382050, Gujarat

Ahmedabad

“Monarch House”, Opp Prahladbhai Patel garden, Near Ishwar Bhuvan, Commerce Six Roads, Navrangpura, Ahmedabad – 380009

Mumbai

Monarch Networth Capital Limited, G Block, Laxmi Tower, B Wing, 4th Floor, Bandra Kurla Complex, Bandra East, Mumbai - 400051.

Phone: 022 - 66476400 / 66476405

Email: cs@mnclgroup.com

Email for Grievance: cs@mnclgroup.com

Listing of Equity Shares on Stock Exchange at

BSE

NSE

(Formerly known as Link Intime India Private Limited)

For any queries related to broking please contact helpdesk@mnclgroup.com.

‘Investments in securities market are subject to market risks, read all the related documents carefully before investing.’